Breaking News

Market Trends

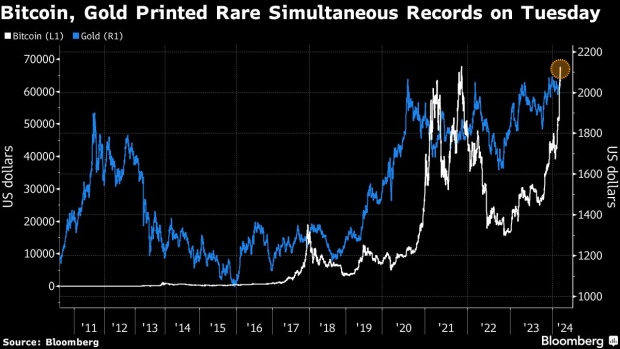

Converging Peaks: Bitcoin and Gold Hit Record Highs Amid Market Uncertainty

Michael Chen

March 6, 2024 - 04:33 am

Twin Peaks: Bitcoin and Gold Reach Simultaneous Records

In an unexpected twist of financial fates, Bitcoin and gold, two assets with historically divergent paths, have concurrently achieved record highs, signaling complex dynamics in global markets' risk appetite.

The recent surge seen by Bitcoin and gold to record levels has sent investors and analysts scrambling to decipher the underlying message regarding risk sentiment within the wider scope of global markets. For the very first time since the advent of Bitcoin over ten years ago, both the digital currency and the time-honored precious metal have set new benchmarks together. Despite the fact that entirely different fundamentals are usually believed to drive their value, their concurrent ascension is noteworthy. Gold has been considered a safe-haven asset for countless generations, whereas Bitcoin’s utility beyond the realm of speculative intrigue remains a polarizing topic.

This year, Bitcoin has witnessed an almost 50% upsurge, a leap attributed partly to capital flowing into newly established US exchange-traded funds (ETFs) which explicitly invest in the cryptocurrency. In contrast, the ascent of gold prices might suggest that investors are adopting a more conservative stance. The reasoning behind this could extend to worries about the potential threats posed by geopolitical unrest or a future downturn in the global stock market after its prolonged streak of record-setting performances.

To reconcile these seemingly disparate signals, one might consider the perspective of traders who pursue short-term momentum across assorted asset classes. Chris Weston, the head of research at Pepperstone Group Ltd., offers some insights into this phenomenon. According to Weston, gold has become the subject of intense trading activities recently, with noticeable surges in volume. "I've had a lot of client calls asking what is happening," Weston commented. He observed that "fast-money" investors are simply pursuing the current trend, which is a pattern discernible within Bitcoin's price movements as well.

One common thread interlinking Bitcoin and gold is the general expectation of more relaxed monetary policy. Data from swaps markets is currently indicating a 62% possibility of an interest-rate reduction by the Federal Reserve come June. This probability represents an uptick from 58% at the close of February.

Bitcoin achieved a historic high of $69,191.95 on a Tuesday trading session in the US, eclipsing the peak it previously attained back in November 2021 during the COVID-19 pandemic. Then the digital currency experienced a mild pullback, stabilising around $63,300 on Wednesday at noon in Singapore.

Gold, on the other hand, soared to a record high of $2,141.79 per ounce on the same Tuesday, surpassing its past record established in the early days of December. The precious metal has demonstrated remarkable growth, with a nearly 5% increase over the past five trading days.

"The crypto narrative can be linked with what is happening in the equity markets and the broader scope of risk-taking," observed Kyle Rodda, a senior market analyst at Capital.Com Inc. "What we're observing—a resurgence in meme coins reflecting irrational, risk-embracing behavior—is in harmony with trends occurring within certain segments of the equity market."

The simultaneous peak performance of both Bitcoin and gold underscores burgeoning expectations for accommodating monetary policy and highlights the intricate interplay of market sentiment driving investor behavior across diverse asset classes. Whether this indicates a broader shift towards either cautious hedging or speculative enthusiasm is an evolving story with implications set to impact investment strategies worldwide.

The real-time ascendancy of Bitcoin and gold can be seen as a manifestation of the conflicting forces of speculation and security-seeking within the financial markets. This duality poses intriguing questions for the future direction of both assets. Will the soaring value of Bitcoin continue to attract investors looking for quick returns? Or will gold's steadiness draw those looking for a refuge against instability? These questions are at the heart of current market analysis and speculation.

In delving into the detailed behaviors that are propelling both assets, investors are likely responding to the nuanced interplay of economic stimuli, regulatory shifts, and geopolitical events. The prominence of ETFs in providing direct access to owning Bitcoin, for example, has reduced barriers to entry for both retail and institutional investors, adding a level of mainstream credibility and liquidity that was less prevalent in the coin's early days.

Concurrently, gold's traditional role as a hedge against inflation and currency devaluation may be finding renewed relevance amid unprecedented levels of government spending and stimulus measures aimed at countering the economic impact of the global health crisis. The precious metal's time-tested stability offers a stark contrast to Bitcoin's relatively short but volatile history.

As markets continue to evolve and adapt, the tale of Bitcoin and gold is one of contrast and comparison, of speculation versus security, and of the search for returns against the backdrop of economic uncertainty. Observers and participants in the financial arena will be watching closely as these two very different assets chart their courses in the months and years ahead.

The full report on this unprecedented alignment of Bitcoin and gold markets can be found on Bloomberg's website, offering a comprehensive analysis and detailed charting of the asset's performances.

For more information, please refer to the original Bloomberg article accessible here.

©2024 Bloomberg L.P. All rights reserved. Use of this content is subject to the terms and conditions set by Bloomberg.

beverage express© 2024 All Rights Reserved